Why Every Finance Manager Should Have Goals

In the intricate tapestry of the financial world, the role of a Finance Manager is both pivotal and demanding. Setting precise and quantifiable goals is not merely advantageous; it is a fundamental necessity. These goals serve as the navigational stars for a Finance Manager's career journey, illuminating the path for strategic decision-making and daily operations. They crystallize the vision of success, ensuring that every analysis, investment, and risk management decision propels the individual and the organization closer to their financial zeniths.

For Finance Managers, well-defined goals are the bedrock of professional growth, fostering innovation and strategic foresight. They are the catalysts that drive the development of cutting-edge financial models, the optimization of capital allocation, and the pursuit of fiscal efficiency. In the realm of leadership, goals are the common language that aligns the aspirations of the Finance Manager with the pulse of their team, harmonizing individual objectives with the broader mission of the company.

The establishment of goals is a declaration of intent, a commitment to excellence that resonates through the corridors of the finance department and beyond. It is a practice that transforms the complex into the achievable, the aspirational into the operational. By embracing the power of goal-setting, Finance Managers not only navigate the currents of economic change but also become the architects of their own career advancement and the stewards of corporate prosperity.

Different Types of Career Goals for Finance Managers

In the dynamic world of finance, a Finance Manager's career goals are as varied as the financial strategies they oversee. Understanding the spectrum of career goals is pivotal for Finance Managers aiming to navigate the complexities of their role with finesse. By setting a mix of short-term and long-term objectives, Finance Managers can ensure that they are not only meeting the immediate demands of their position but also paving the way for future advancement and success.

Financial Expertise and Certification Goals

Financial expertise and certification goals are about deepening your knowledge and gaining recognition in the finance industry. This could involve pursuing advanced certifications such as the CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant), which can enhance your credibility and open up new career opportunities. These goals ensure you remain updated with the latest financial regulations, accounting standards, and investment strategies, keeping you competitive and well-equipped to handle complex financial scenarios.

Strategic Planning and Execution Goals

Goals centered around strategic planning and execution focus on your ability to not only devise robust financial strategies but also to implement them effectively. This might include leading a successful budget overhaul, reducing company costs through innovative financial solutions, or managing a high-stakes merger or acquisition. These goals highlight your capacity to translate financial insights into actionable plans that drive organizational growth and stability.

Leadership and Team Development Goals

Leadership and team development goals emphasize your role in guiding and nurturing the finance team. As a Finance Manager, you might aim to mentor emerging talent, foster a culture of continuous improvement, or enhance cross-departmental collaboration. These goals reflect your commitment to not just managing numbers but also leading people, building a cohesive team that can navigate financial challenges with expertise and confidence.

Technology Integration and Data Analysis Goals

In an era where data reigns supreme, goals related to technology integration and data analysis are crucial. They involve staying abreast of financial software advancements, harnessing the power of big data to inform financial decisions, or leading initiatives to automate financial processes. By achieving these goals, you position yourself at the intersection of finance and technology, leveraging tools that enhance accuracy, efficiency, and strategic insight.

Networking and Industry Presence Goals

Networking and industry presence goals are about expanding your professional circle and establishing yourself as a thought leader in the finance field. This could mean actively participating in industry conferences, contributing to financial publications, or joining professional organizations. These goals are instrumental in building a robust network that can offer new perspectives, opportunities for collaboration, and potential career advancements.

By setting and pursuing a diverse array of career goals, Finance Managers can cultivate a well-rounded skill set and professional presence that not only meets the demands of their current role but also lays the groundwork for future opportunities and achievements in the finance industry.

What Makes a Good Career Goal for a Finance Manager?

In the fast-paced and ever-evolving financial landscape, setting precise career goals is not just a step towards advancement but a commitment to excellence. For Finance Managers, these goals are the compass that navigates through the complexities of fiscal management, corporate strategy, and leadership. They are the milestones that mark not only career progression but also the enhancement of one's ability to shape the financial future of their organization.

Career Goal Criteria for Finance Managers

Relevance to Financial Expertise and Trends

A robust career goal for a Finance Manager must be deeply rooted in their area of expertise while also taking into account emerging financial trends. It should reflect a profound understanding of financial principles and the ability to apply them in a way that drives innovation and efficiency within the organization.

Master Financial Data Analysis

Stay Abreast of Regulatory Changes

Adopt Cutting-Edge Fintech Solutions

Contribution to Organizational Financial Health

The goals of a Finance Manager should directly contribute to the financial well-being and strategic objectives of their company. This means setting targets that enhance profitability, reduce costs, and optimize investment strategies, thereby demonstrating the tangible value of their role.

Develop Cost-Saving Initiatives

Implement Revenue Growth Plans

Enhance Financial Reporting Accuracy

Leadership and Influence

Good career goals for Finance Managers should encompass the development of leadership skills and the capacity to influence others. As stewards of financial integrity, they must aim to inspire confidence and foster a culture of transparency and ethical decision-making within their teams and the broader organization.

Enhance Team Leadership Skills

Drive Ethical Financial Practices

Build Cross-Departmental Influence

Professional Certification and Continuing Education

In a field where professional credentials are highly valued, Finance Managers should set goals around achieving or maintaining relevant certifications. This not only bolsters their credibility but also ensures they remain at the forefront of accounting standards, regulatory compliance, and financial best practices.

Obtain CFA or CPA Designation

Engage in Regular IFRS/FASB Updates

Attend Industry-Specific Financial Workshops

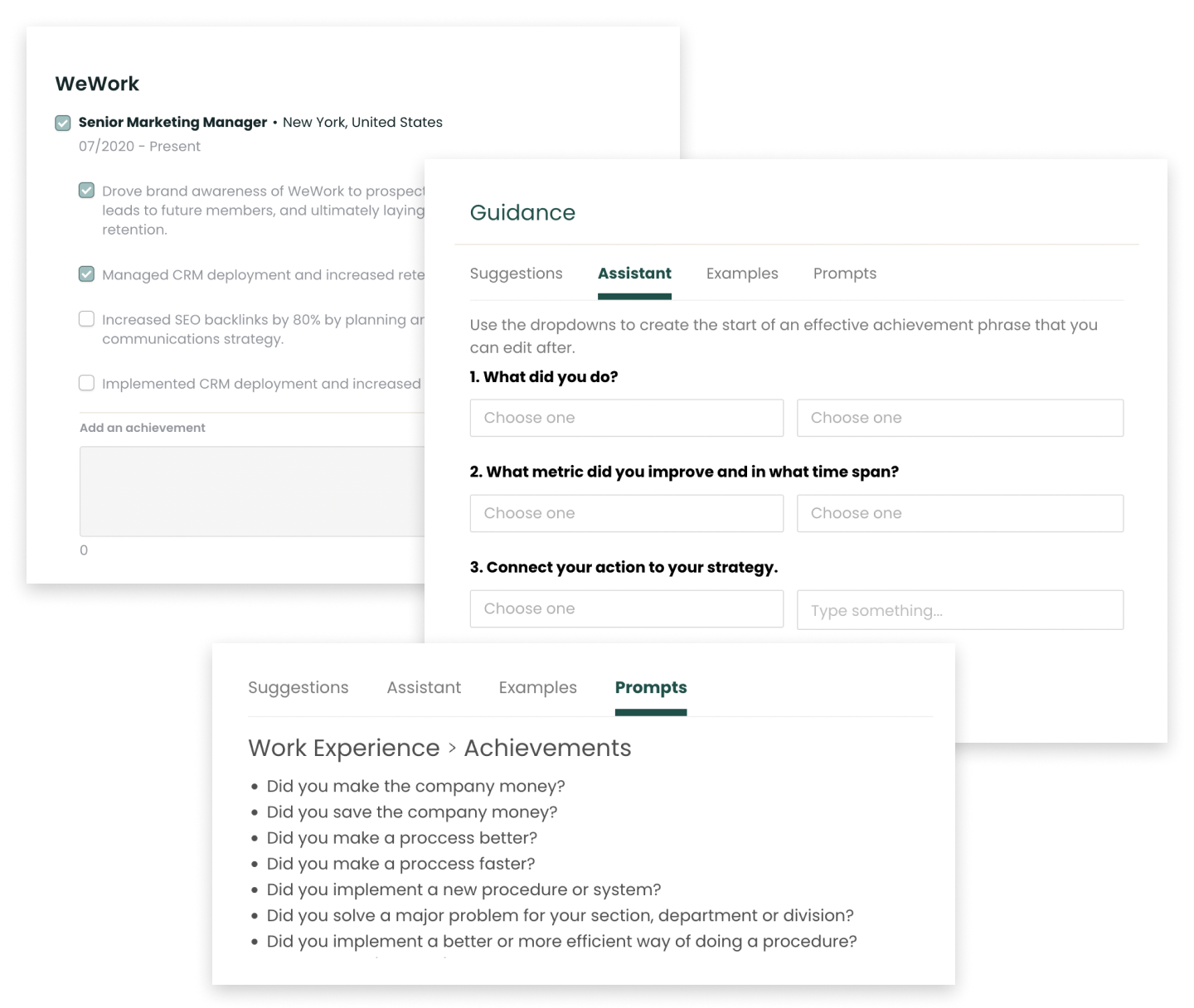

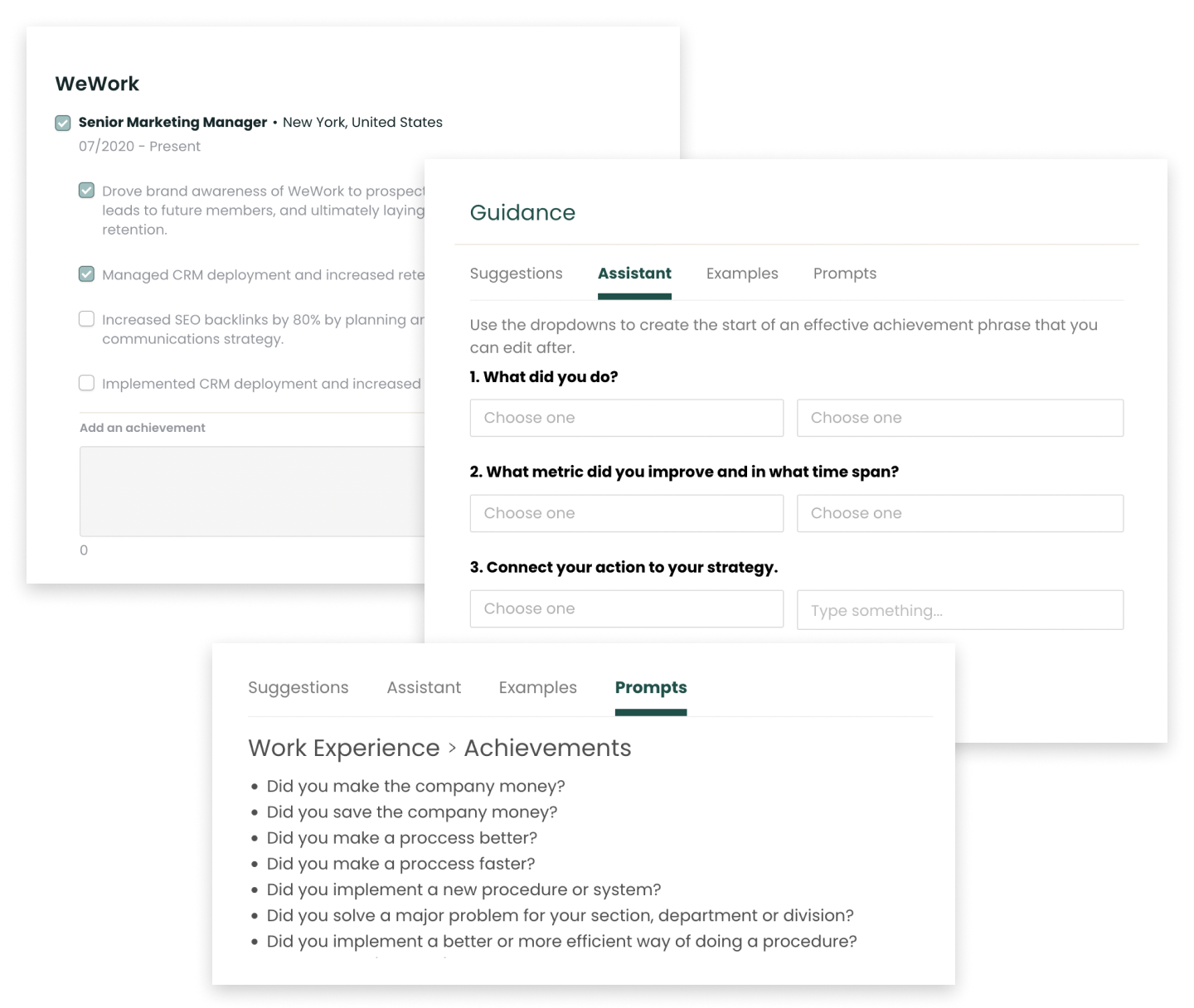

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Finance Managers

Setting professional goals is essential for Finance Managers who aim to navigate the complexities of financial strategy and management effectively. These goals provide a clear path for career growth, enhance the ability to lead successful financial projects, and shape the professional journey within the finance industry. Below are thoughtfully selected professional goal examples for Finance Managers, each designed to inspire and guide them toward strategic career progression and personal achievement.

Achieve Expertise in Financial Forecasting and Modeling

Develop a deep understanding of financial forecasting and modeling techniques. This goal involves becoming proficient in advanced Excel functions, learning to use specialized software, and staying updated on the latest industry trends. Mastery in this area will enable you to provide accurate financial projections and drive informed business decisions.

Strengthen Compliance and Risk Management Skills

Focus on enhancing your knowledge of regulatory compliance and risk management. This goal means staying abreast of changing regulations, understanding the implications for your organization, and implementing robust risk assessment frameworks. A Finance Manager adept in these areas is invaluable for maintaining the company's financial integrity and reputation.

Lead a Cost Reduction Initiative

Initiate and successfully execute a cost reduction strategy within your organization. This goal will challenge you to analyze spending patterns, identify inefficiencies, and implement cost-saving measures without compromising on quality or productivity. It's a testament to your ability to optimize financial resources and contribute to the company's profitability.

Expand Financial Reporting Capabilities

Set a goal to enhance the comprehensiveness and clarity of financial reporting. This involves not only mastering the creation of standard financial statements but also developing custom reports that provide deeper insights into the company's financial health. Improved reporting aids strategic decision-making and transparency with stakeholders.

Cultivate Leadership in Financial Team Management

Aim to grow as a leader by developing your financial team's skills and performance. This goal could include mentoring team members, fostering a culture of continuous learning, and leading by example in ethical financial practices. By investing in your team, you enhance collective expertise and drive departmental success.

Drive Business Growth through Strategic Financial Analysis

Commit to using strategic financial analysis as a tool for identifying and capitalizing on growth opportunities. This goal involves conducting thorough market analyses, evaluating investment options, and supporting strategic business initiatives with sound financial data and recommendations.

Obtain a Professional Finance Certification

Pursue and achieve a professional certification, such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant). This goal not only broadens your expertise but also demonstrates your dedication to professional excellence and adherence to industry standards.

Implement Financial Process Automation

Lead the charge in automating financial processes within your organization. This goal requires you to identify opportunities for automation, select the right technology solutions, and manage the transition to more efficient, error-free processes. Automation can significantly enhance productivity and accuracy in financial operations.

Develop International Financial Management Skills

Expand your proficiency in international finance, including foreign exchange risk management, international taxation, and cross-border financial strategies. This goal is particularly relevant for Finance Managers in multinational corporations or those looking to prepare for global finance roles.

Foster Ethical Financial Practices

Set an example in ethical financial management by promoting transparency, accountability, and integrity in all financial activities. This goal involves establishing and upholding strong ethical standards within your team and ensuring that financial practices align with the company's values and regulatory requirements.

Master Capital Budgeting and Investment Appraisal

Enhance your ability to evaluate and manage capital investment projects effectively. This goal means becoming adept at techniques like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period, which are critical for making sound investment decisions that align with the company's strategic objectives.

Lead Financial Digital Transformation

Embrace the role of a change agent by spearheading a digital transformation in the finance department. This goal is about integrating cutting-edge technologies, such as AI and blockchain, into financial operations to increase efficiency, improve data analysis, and drive innovation in financial management.

Find Finance Manager Openings

Explore the newest Finance Manager roles across industries, career levels, salary ranges, and more.

Career Goals for Finance Managers at Difference Levels

Setting career goals is a pivotal aspect of professional development, particularly in the multifaceted role of a Finance Manager. As individuals progress through their careers, their objectives must evolve to reflect their expanding expertise, responsibilities, and the strategic direction of their organizations. Establishing stage-specific career goals ensures that Finance Managers remain aligned with their current competencies while also preparing for future challenges and opportunities. This section delves into the career goals that Finance Managers should aspire to at different stages of their professional journey, providing a clear and motivational guide for continuous advancement and success in the finance industry.

Setting Career Goals as an Entry-Level Finance Manager

At the entry-level, the primary aim is to cultivate a robust foundation in financial analysis, reporting, and regulatory compliance. Goals should include developing proficiency in financial software, understanding the nuances of financial statements, and participating in budget preparation and monitoring. These objectives are not merely tasks to be completed but are crucial for establishing credibility and a deep understanding of the financial operations within an organization.

Setting Career Goals as a Mid-Level Finance Manager

As a mid-level Finance Manager, you're expected to contribute more significantly to the organization's financial strategy. Your goals should now focus on enhancing analytical skills, leading complex financial projects, and improving the company's financial health. Consider setting objectives like optimizing cash flow management, implementing cost-saving initiatives, or developing financial models for new business opportunities. At this stage, your goals should balance technical financial expertise with leadership and strategic thinking.

Setting Career Goals as a Senior-Level Finance Manager

At the senior level, you are a strategic partner in the business. Your goals should reflect a comprehensive understanding of the company's financial picture and its alignment with overall business strategy. Aim for objectives such as leading company-wide financial planning, advising on mergers and acquisitions, or driving the financial strategy that supports long-term business growth. As a senior Finance Manager, your goals should not only demonstrate your financial acumen but also your ability to influence decision-making and contribute to the company's success at the highest level.

Leverage Feedback to Refine Your Professional Goals

Feedback is an indispensable asset for Finance Managers, serving as a compass for navigating the complexities of the financial landscape. It provides invaluable insights from various perspectives, which can be instrumental in shaping a Finance Manager's career path, ensuring continuous improvement and relevance in an ever-evolving field.

Utilizing Constructive Criticism to Sharpen Financial Acumen

Constructive criticism is a powerful catalyst for professional growth. As a Finance Manager, harness this feedback to enhance your strategic planning, risk assessment, and decision-making skills. Let it guide you in refining your career objectives to become a more effective leader in the finance sector.

Incorporating Customer Insights to Drive Financial Innovation

Customer feedback is a treasure trove of information that can inform your financial strategies and goals. Use these insights to anticipate market shifts and customer needs, positioning yourself as a forward-thinking Finance Manager who contributes to the company's bottom line through customer-centric financial solutions.

Leveraging Performance Reviews for Strategic Career Development

Performance reviews offer a structured evaluation of your achievements and areas for improvement. Analyze this feedback to set clear, actionable goals that focus on enhancing your competencies and aligning with the company's strategic objectives, paving the way for career progression and success in the field of finance.

Goal FAQs for Finance Managers

How frequently should Finance Managers revisit and adjust their professional goals?

Finance Managers should reassess their professional goals at least biannually, aligning with fiscal periods to stay attuned to economic trends, regulatory changes, and company performance. This semi-annual check-in fosters strategic agility and ensures their objectives support both their personal development and the financial health of their organization.

Can professional goals for Finance Managers include soft skill development?

Certainly. For Finance Managers, mastering soft skills such as effective communication, leadership, and strategic thinking is essential. These skills facilitate stronger team dynamics, improved negotiation outcomes, and better cross-departmental collaboration. Developing these areas can enhance decision-making processes and financial strategy execution, making them vital goals for any Finance Manager looking to excel in their role.

How do Finance Managers balance long-term career goals with immediate project deadlines?

Finance Managers must adeptly navigate the intersection of immediate financial projects and long-term career advancement. By prioritizing tasks that enhance strategic financial acumen and leadership qualities, they can ensure that meeting short-term deadlines also propels their professional development. This dual focus requires meticulous time management and a commitment to continuous learning, ensuring that each project milestone also serves as a stepping stone towards their overarching career objectives.

How can Finance Managers ensure their goals align with their company's vision and objectives?

Finance Managers must stay attuned to their company's financial health and strategic plans through ongoing dialogue with executive leadership and key stakeholders. By understanding the broader economic context and the company's long-term vision, they can tailor their financial strategies and objectives to support sustainable growth. This alignment not only propels the company forward but also enhances the Finance Manager's role as a strategic partner within the organization.

Up Next

What is a Finance Manager?

Learn what it takes to become a JOB in 2024