Why Every Finance Director Should Have Goals

In the intricate tapestry of corporate finance, the role of a Finance Director is both pivotal and complex. Establishing specific, measurable goals is not merely advantageous; it is imperative. These goals serve as a career compass, steering every strategic decision and action within the financial realm. They crystallize the vision of success, ensuring that each endeavor is a deliberate stride towards the ultimate career milestones. For Finance Directors, well-defined goals are the bedrock of professional evolution, fostering innovation, strategic foresight, and exemplary leadership.

Goals provide the much-needed direction and clarity that Finance Directors require to navigate their daily responsibilities and long-term career aspirations. They are the silent beacons that illuminate the path to financial stewardship, enabling these professionals to dissect the complexities of fiscal management with precision and confidence. By setting and pursuing targeted objectives, Finance Directors can spearhead innovation, turning financial data into strategic opportunities that drive growth and competitive advantage.

Moreover, goal-setting is instrumental in enhancing leadership qualities within the Finance Director role. It is the glue that aligns individual ambition with team efforts and the broader organizational vision. Goals serve as a rallying point for finance teams, fostering a culture of accountability and collective progress. They are the catalysts that transform financial leaders into strategic partners, integral to the fabric of the organization's success.

This introduction is designed to motivate and provide practical insights into the benefits of goal-setting for Finance Director professionals. It aims to inspire readers to recognize and harness the power of well-articulated goals in carving out a successful and impactful career in finance.

Different Types of Career Goals for Finance Directors

In the dynamic role of a Finance Director, setting a variety of career goals is essential for steering your professional journey. These goals are the compass that guides you through the complexities of financial management, strategic planning, and organizational leadership. By identifying and pursuing a range of objectives, you can ensure a well-rounded development path that not only focuses on immediate financial projects but also on your long-term evolution as a leader in finance.

Financial Expertise and Technical Proficiency Goals

Financial expertise goals are about deepening your understanding of financial principles, accounting standards, and regulatory requirements. This might involve pursuing advanced certifications such as CPA or CFA, or mastering the latest financial software and analytical tools. These goals ensure you maintain the technical proficiency required to navigate the ever-evolving financial landscape and uphold the fiscal integrity of your organization.

Strategic Leadership and Organizational Influence Goals

Strategic leadership goals center on your capacity to shape the financial strategy and contribute to the overall direction of the company. This could mean leading a successful merger or acquisition, developing a robust financial framework to support company growth, or influencing corporate governance with insightful financial reporting. These goals reflect your evolution from overseeing financial operations to becoming a strategic partner in the business, with a voice that resonates in the boardroom.

Operational Efficiency and Innovation Goals

Operational efficiency goals focus on streamlining financial processes, reducing costs, and enhancing profitability. They might involve implementing new financial systems, adopting automation technologies, or redesigning budgeting and forecasting models. Innovation goals in finance also include finding creative solutions to financial challenges, such as developing new financing structures or integrating sustainable financial practices. These goals are about driving change that not only improves the bottom line but also positions the company as a forward-thinking leader in financial management.

What Makes a Good Career Goal for a Finance Director?

In the high-stakes world of finance, a Finance Director's career goals are the compass that guides their professional journey. These goals are not just milestones to be reached but are pivotal in shaping a leader who is adept at navigating the complexities of financial strategy, corporate governance, and team leadership. They are the bedrock upon which a Finance Director builds their capacity to drive innovation and steer their organization towards fiscal excellence.

Career Goal Criteria for Finance Directors

Strategic Financial Leadership

A Finance Director's career goal should encompass the development of strategic financial leadership skills. This involves not just managing budgets and forecasts, but also shaping the financial strategy that supports the company's long-term objectives. It's about understanding the market, driving growth, and being able to communicate financial insights that inform corporate decisions.

Master Financial Forecasting

Enhance Stakeholder Communication

Drive Fiscal Policy Innovation

Regulatory Mastery and Compliance

In the ever-evolving landscape of financial regulations, a Finance Director must aim to stay ahead of compliance issues. Goals should include a deep dive into mastering regulatory frameworks and implementing robust compliance mechanisms. This ensures the organization not only avoids costly penalties but also maintains its reputation in the market.

Stay Updated on New Regulations

Implement Proactive Audit Practices

Develop a Compliance Training Program

Technological Proficiency and Innovation

With the financial sector increasingly leaning on technology, a good career goal for a Finance Director is to become proficient in the latest financial technologies and systems. This means not only understanding but also leading the charge in implementing innovative solutions that improve efficiency, reduce risk, and provide competitive advantage.

Master Data Analytics Tools

Lead FinTech Adoption

Champion Cybersecurity Measures

Cross-Functional Collaboration

Finance Directors must set goals that foster cross-functional collaboration. The ability to work seamlessly with other departments is crucial for a holistic understanding of the business and for driving integrated strategies. This involves building strong relationships and communication channels that break down silos and align financial objectives with broader company goals.

Establish Interdepartmental KPIs

Cultivate Financial Literacy

Champion Collaborative Projects

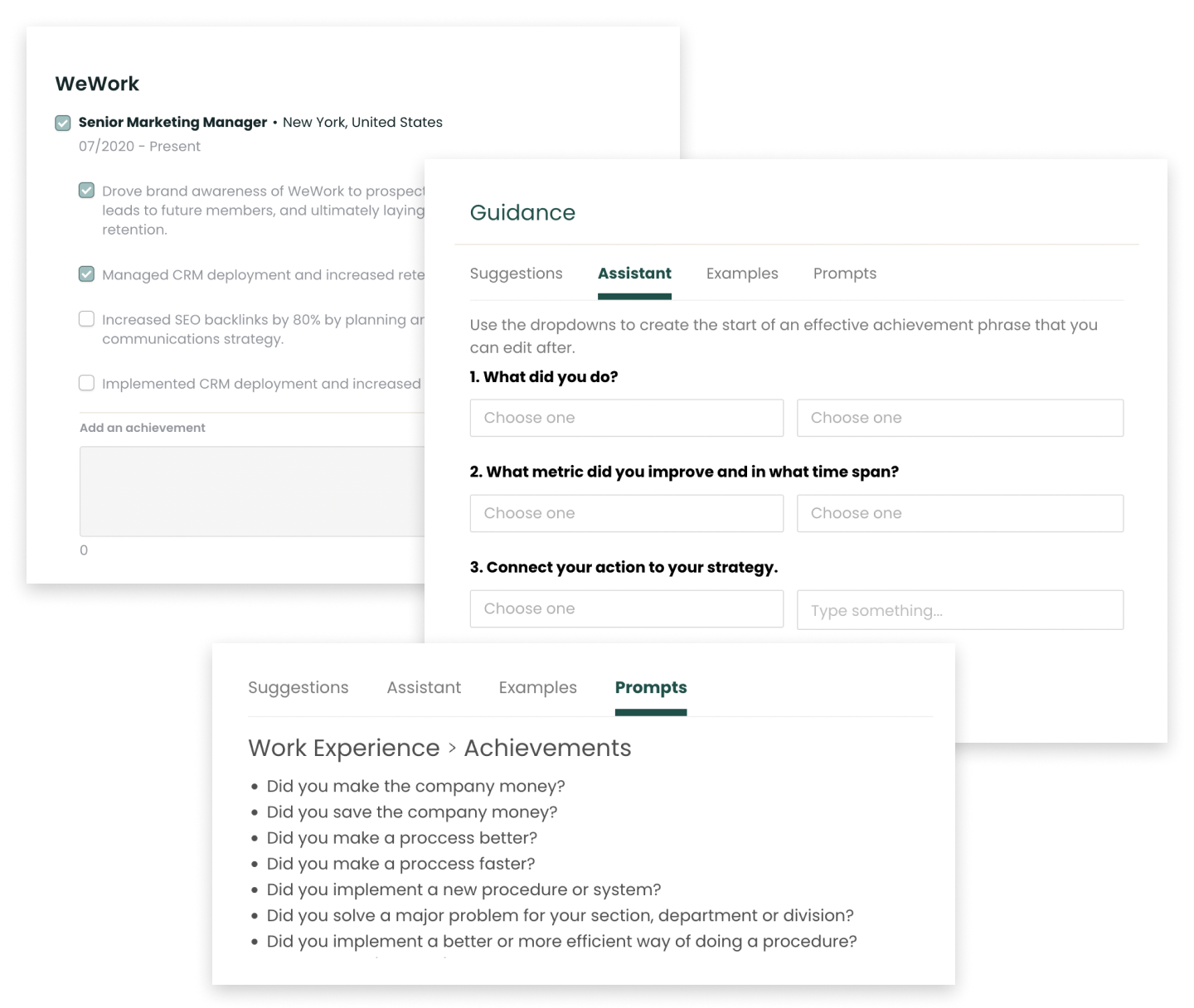

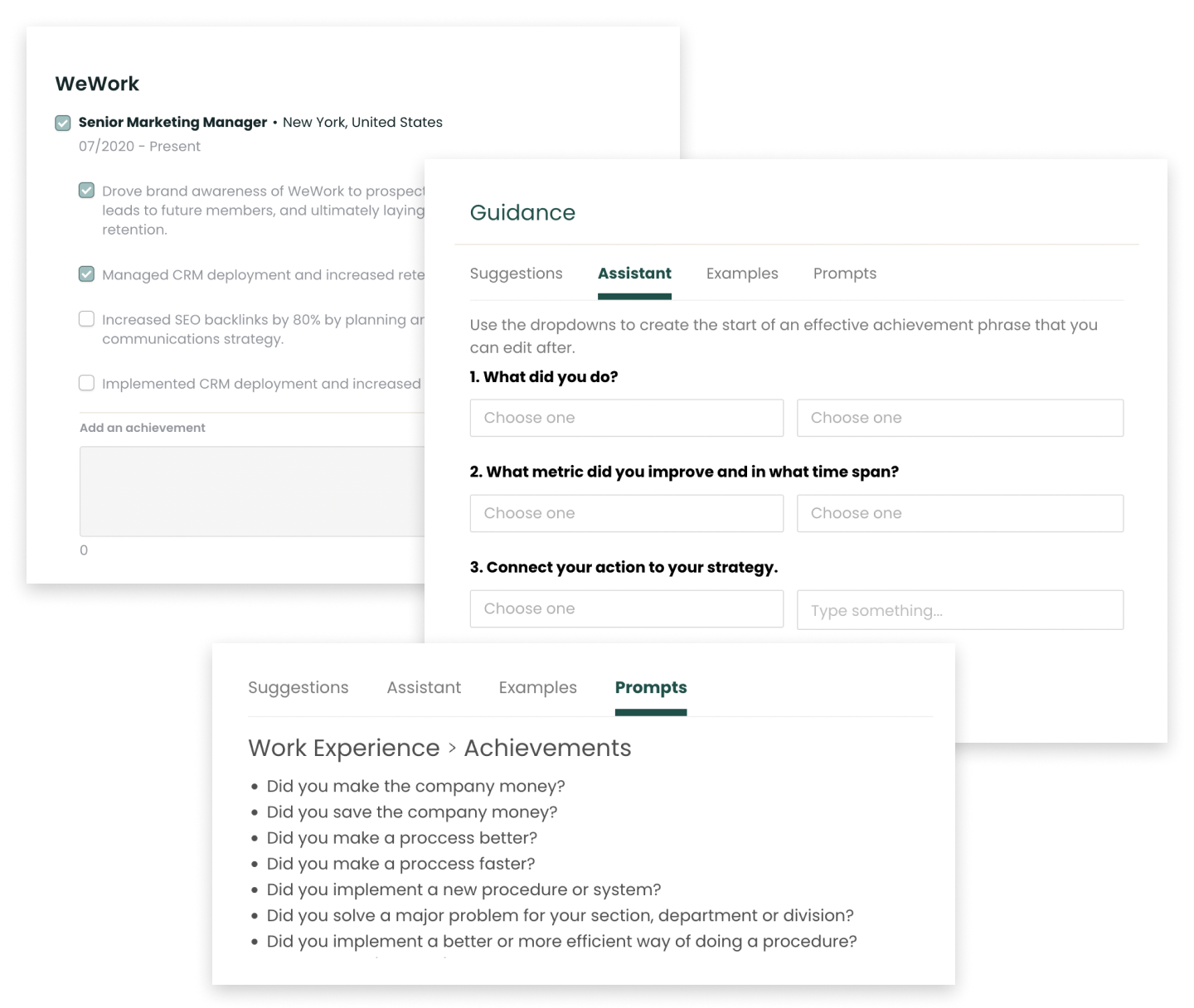

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Finance Directors

Setting professional goals as a Finance Director is essential for steering your financial leadership in a strategic direction. These goals not only help in navigating the complexities of financial management but also in shaping the growth trajectory of your organization and your career. Below are targeted professional goal examples for Finance Directors, each designed to inspire and guide you towards impactful and strategic career progression.

Enhance Financial Forecasting Accuracy

Improving the precision of financial forecasts is paramount for a Finance Director. Commit to mastering new forecasting models and technologies that can provide deeper insights and more accurate predictions. This goal will help in better financial planning and risk management, ultimately leading to more confident and informed decision-making.

Drive Cost Optimization Initiatives

Set a goal to identify and implement cost-saving measures that do not compromise on the quality of operations. This involves conducting thorough spend analysis, renegotiating contracts, and streamlining processes. Achieving this goal will not only improve the bottom line but also demonstrate your ability to operate efficiently within budget constraints.

Develop and Execute a Capital Strategy

As a Finance Director, aim to create and execute a robust capital strategy that aligns with your company's long-term goals. This includes managing debt, equity financing, and investments to optimize the capital structure. Success in this area signifies your strategic foresight and ability to secure the financial health of the organization.

Lead a Digital Transformation in Finance

Set the objective to lead a digital transformation within the finance department. This could involve implementing new financial management software, automating processes, or adopting advanced analytics. Embracing digital tools can enhance efficiency, accuracy, and provide real-time financial insights.

Strengthen Compliance and Control Systems

Aim to reinforce your organization's financial compliance and internal control systems. This goal entails staying updated with regulatory changes, ensuring all financial practices are compliant, and mitigating risks. A strong command over compliance demonstrates your commitment to governance and ethical financial management.

Expand Financial Leadership Skills

Target the development of your leadership skills by taking on cross-departmental projects, mentoring junior finance staff, or leading financial strategy workshops. This goal helps in building a cohesive team and positions you as a visionary leader in your organization.

Cultivate Investor Relations

Enhance your investor relations skills by setting a goal to communicate effectively with shareholders and potential investors. This includes delivering clear financial reports, articulating investment opportunities, and building trust through transparency. Strong investor relations can lead to increased investment and shareholder value.

Master Regulatory and Tax Planning

Commit to becoming an expert in the latest regulatory requirements and tax planning strategies. This goal involves continuous learning and application of new tax laws to optimize the company's tax position. Mastery in this area can result in significant savings and a strong compliance reputation.

Implement Sustainable Financial Practices

Set a goal to integrate sustainability into the company's financial practices. This could involve investing in green initiatives, reporting on sustainability metrics, or developing eco-friendly procurement policies. Promoting sustainable finance aligns your organization with global sustainability goals and can improve brand reputation.

Achieve a Professional Finance Certification

Pursue an advanced professional certification, such as CFA or CPA, to deepen your expertise and credibility in the finance field. This goal not only broadens your knowledge base but also signals to your peers and superiors your dedication to staying at the forefront of financial best practices.

Optimize Cash Flow Management

Focus on optimizing cash flow management to ensure liquidity and operational efficiency. This includes improving receivables collection, managing payables, and maintaining adequate cash reserves. Effective cash flow management is critical for the stability and growth of the business.

Foster a Data-Driven Finance Culture

Encourage a culture within your finance team that values data-driven decision-making. This goal involves investing in training for data analytics tools and creating a mindset that looks to data for insights and strategic direction. A data-driven approach can lead to more accurate financial projections and better business outcomes.

Find Finance Director Openings

Explore the newest Finance Director roles across industries, career levels, salary ranges, and more.

Career Goals for Finance Directors at Difference Levels

Setting career goals is a pivotal aspect of a Finance Director's professional journey, as these objectives guide their path through the complex landscape of corporate finance. As one progresses from entry-level to senior positions, goals must be recalibrated to reflect the evolving responsibilities and the expanding scope of influence. It's essential for Finance Directors to set stage-specific goals that not only align with their current competencies and challenges but also propel them towards their long-term aspirations and the broader financial objectives of the organizations they serve.

Setting Career Goals as an Entry-Level Finance Director

At the entry-level, a Finance Director should concentrate on establishing a robust understanding of the company's financial operations and strategic objectives. Goals might include developing comprehensive financial models, improving financial reporting accuracy, or leading a small-scale budgeting project. These objectives serve as the bedrock for a successful finance career, ensuring a deep comprehension of the financial underpinnings that drive business decisions.

Setting Career Goals as a Mid-Level Finance Director

Mid-level Finance Directors must elevate their goals to reflect their growing responsibility in steering the company's financial strategy. Objectives should focus on enhancing leadership skills, optimizing capital structure, and driving cost-reduction initiatives. Consider spearheading a cross-departmental project to align financial goals with operational performance or mentoring upcoming finance talent. At this juncture, goals should balance the immediate financial needs of the company with the personal development necessary to prepare for more senior roles.

Setting Career Goals as a Senior-Level Finance Director

Senior-level Finance Directors are expected to be strategic visionaries and influential leaders within their organizations. Goals should be ambitious, such as leading a company through a major financial transformation, developing a robust risk management framework, or playing a key role in mergers and acquisitions. At this stage, a Finance Director's objectives should not only demonstrate their financial acumen but also their ability to drive strategic growth and to contribute significantly to the company's long-term success.

Leverage Feedback to Refine Your Professional Goals

Feedback is an invaluable asset for Finance Directors, serving as a compass for navigating the complexities of the financial landscape. It provides a foundation for continuous improvement, helping to shape a Finance Director's career path through insights from various stakeholders.

Utilizing Constructive Criticism to Sharpen Financial Acumen

Constructive criticism is a powerful tool for Finance Directors to enhance their strategic thinking and financial management skills. Embrace this feedback to refine your approach to fiscal challenges, improve your leadership capabilities, and ensure your professional objectives are in sync with the evolving needs of your organization.

Incorporating Stakeholder Insights into Strategic Financial Planning

Stakeholder feedback, including that from customers, investors, and internal teams, is crucial for aligning financial strategies with business objectives. Use these insights to tailor your financial plans and career goals, ensuring they contribute to the overall success and sustainability of the business.

Leveraging Performance Reviews for Goal Realignment

Performance reviews offer a structured evaluation of your achievements and areas for development. Analyze this feedback to set precise, actionable goals that focus on enhancing your strengths and addressing any weaknesses, leading to a more impactful and successful career trajectory in finance.

Goal FAQs for Finance Directors

How frequently should Finance Directors revisit and adjust their professional goals?

Finance Directors should evaluate their professional goals at least biannually, aligning with fiscal periods to stay attuned to economic trends, regulatory changes, and corporate strategy shifts. This semi-annual review ensures their objectives support organizational financial health and personal career advancement, while allowing flexibility to adapt to the evolving financial landscape.

Can professional goals for Finance Directors include soft skill development?

Certainly. For Finance Directors, mastering soft skills such as effective communication, strategic relationship-building, and leadership is essential. These competencies facilitate cross-departmental collaboration, enhance team performance, and support successful negotiations. Prioritizing soft skill development in their professional goals can significantly contribute to a Finance Director's ability to drive organizational growth and navigate complex financial landscapes with agility.

How do Finance Directors balance long-term career goals with immediate project deadlines?

Finance Directors must adeptly navigate the intersection of strategic foresight and operational efficiency. By embedding long-term financial objectives into the fabric of short-term projects, they ensure that each deadline met also propels their career trajectory. This requires a meticulous approach to resource allocation, prioritizing tasks that serve both immediate outcomes and advance professional development, while maintaining a keen eye on the evolving financial landscape to adapt goals as necessary.

How can Finance Directors ensure their goals align with their company's vision and objectives?

Finance Directors must immerse themselves in the strategic planning process, engaging with executives to grasp the broader company vision. By integrating financial insights with organizational objectives, they can tailor their goals to bolster the company's financial health and growth. This synergy not only propels the company forward but also enhances the Finance Director's leadership role and career trajectory within the organization.

Up Next

What is a Finance Director?

Learn what it takes to become a JOB in 2024