Why Every Tax Manager Should Have Goals

In the intricate labyrinth of tax management, the establishment of precise, measurable goals is not merely advantageous; it is imperative. These goals serve as the navigational stars for Tax Managers, steering every audit, regulation interpretation, and fiscal analysis. They carve out a clear path to what achievement looks like, ensuring that each meticulous calculation and strategic tax planning effort propels you toward your ultimate career milestones. For Tax Managers, well-defined goals are the bedrock of professional growth, fostering innovation, and enhancing strategic foresight. They are the catalysts that transform routine tasks into stepping stones for career progression and empower leaders to pilot their teams in alignment with the company's financial and ethical compass.

In this role, goals are the lenses through which clarity and precision in daily responsibilities come into focus, and long-term aspirations become attainable. By setting goals, Tax Managers can ignite the spark of innovation within their teams, encouraging novel approaches to tax optimization and compliance. Strategic planning becomes more than a buzzword; it evolves into a disciplined practice, with goals acting as milestones marking the journey toward excellence. Moreover, the synchronization of individual goals with team objectives and the broader organizational vision ensures a cohesive, forward-moving entity, where every member understands their role in the fiscal narrative of the company.

This introduction is designed to motivate Tax Managers to recognize and harness the power of goal-setting, not just as a theoretical exercise, but as a practical toolkit for carving out a distinguished and successful career in the tax domain. It is a call to action, urging professionals to craft and pursue goals that will lead to innovation, strategic mastery, and effective leadership within the dynamic world of tax management.

Different Types of Career Goals for Tax Managers

In the dynamic world of taxation, a Tax Manager's career goals are as varied as the tax codes and regulations they navigate. Understanding the spectrum of career goals is essential for Tax Managers who aim to cultivate a well-rounded professional journey. It's about striking the right balance between short-term achievements in handling complex tax projects and setting sights on long-term career milestones. This strategic approach ensures that every initiative and learning opportunity contributes to a fulfilling career trajectory.

Technical Proficiency Goals

Technical proficiency goals are about staying current with the ever-evolving tax laws, regulations, and compliance requirements. For Tax Managers, this could mean pursuing advanced tax certifications, becoming an expert in international tax law, or mastering new tax software. These goals ensure that you maintain a competitive edge by offering expert guidance and minimizing tax liabilities for your clients or organization.

Strategic Leadership Goals

Strategic leadership goals focus on the ability to not only manage tax-related tasks but also to lead and influence the broader financial strategy of an organization. This might involve developing a tax strategy that aligns with the company's business goals, mentoring junior tax professionals, or taking on executive roles such as Tax Director or Chief Financial Officer. These goals reflect the transition from technical tax work to strategic decision-making and organizational leadership.

Networking and Reputation Goals

Networking and reputation goals are centered on building a robust professional network and establishing a reputation as a thought leader in the tax field. This could involve speaking at industry conferences, publishing articles on tax matters, or actively participating in professional tax associations. By achieving these goals, Tax Managers can open doors to new opportunities, attract high-profile clients, and influence tax policy discussions.

Operational Excellence Goals

Operational excellence goals aim at enhancing the efficiency and effectiveness of tax functions within an organization. Tax Managers may set goals to streamline tax processes, implement innovative tax planning strategies, or optimize the use of technology for tax reporting. Achieving these goals can lead to significant cost savings, risk reduction, and improved compliance for their employers, showcasing the Tax Manager's direct impact on the organization's bottom line.

Personal Development Goals

Personal development goals for Tax Managers involve continuous learning and self-improvement that goes beyond technical tax knowledge. This might include enhancing soft skills such as public speaking, conflict resolution, or time management. Personal development is crucial for Tax Managers who aspire to lead with confidence, communicate effectively with stakeholders, and manage high-performing teams.

By setting and pursuing a diverse array of career goals, Tax Managers can ensure a rich and rewarding career path that not only meets the immediate demands of their role but also paves the way for future success and leadership in the field of taxation.

What Makes a Good Career Goal for a Tax Manager?

In the intricate world of taxation, setting precise career goals is not just about climbing the professional ladder; it's about becoming a beacon of expertise, a guardian of compliance, and a pioneer of fiscal strategy. For Tax Managers, well-defined goals are the compass that navigates the complex and ever-changing tax landscape, enhancing their ability to lead with confidence, innovate within the industry, and drive their organizations to financial prudence and success.

Career Goal Criteria for Tax Managers

Mastery of Tax Regulations

A Tax Manager must aim for an in-depth understanding of current and emerging tax laws. This goal is crucial as it ensures they can navigate the complexities of tax codes and provide accurate, strategic advice. Mastery also positions them as authoritative voices in the field, ready to lead their teams through regulatory mazes with skill and confidence.

Stay Abreast of Tax Law Changes

Develop Tax Planning Strategies

Lead with Tax Compliance Expertise

Technological Proficiency

In an era where tax software and data analytics are integral to the profession, Tax Managers should set goals to become proficient in the latest technological tools. This not only increases efficiency and accuracy in tax preparation and planning but also enables them to stay ahead in a digitally evolving landscape, offering innovative solutions to their clients or organization.

Master Tax Software Suites

Stay Abreast of Tech Trends

Implement Data Analysis Tools

Leadership and Team Development

Effective Tax Managers are also exceptional leaders. Goals related to enhancing leadership skills and developing high-performing teams are vital. They ensure that the Tax Manager can foster a culture of continuous improvement, mentorship, and collaboration, which is essential for delivering exceptional service and navigating the challenges of tax season.

Implement Leadership Training

Cultivate Team Expertise

Encourage Collaborative Projects

Strategic Business Acumen

A Tax Manager should not only be a tax expert but also a strategic business thinker. Setting goals to understand the broader business environment and its financial mechanisms allows Tax Managers to contribute to their organization's strategic planning and decision-making processes, aligning tax strategies with business objectives.

Master Cross-Functional Collaboration

Enhance Financial Forecasting Skills

Integrate Tax with Business Strategy

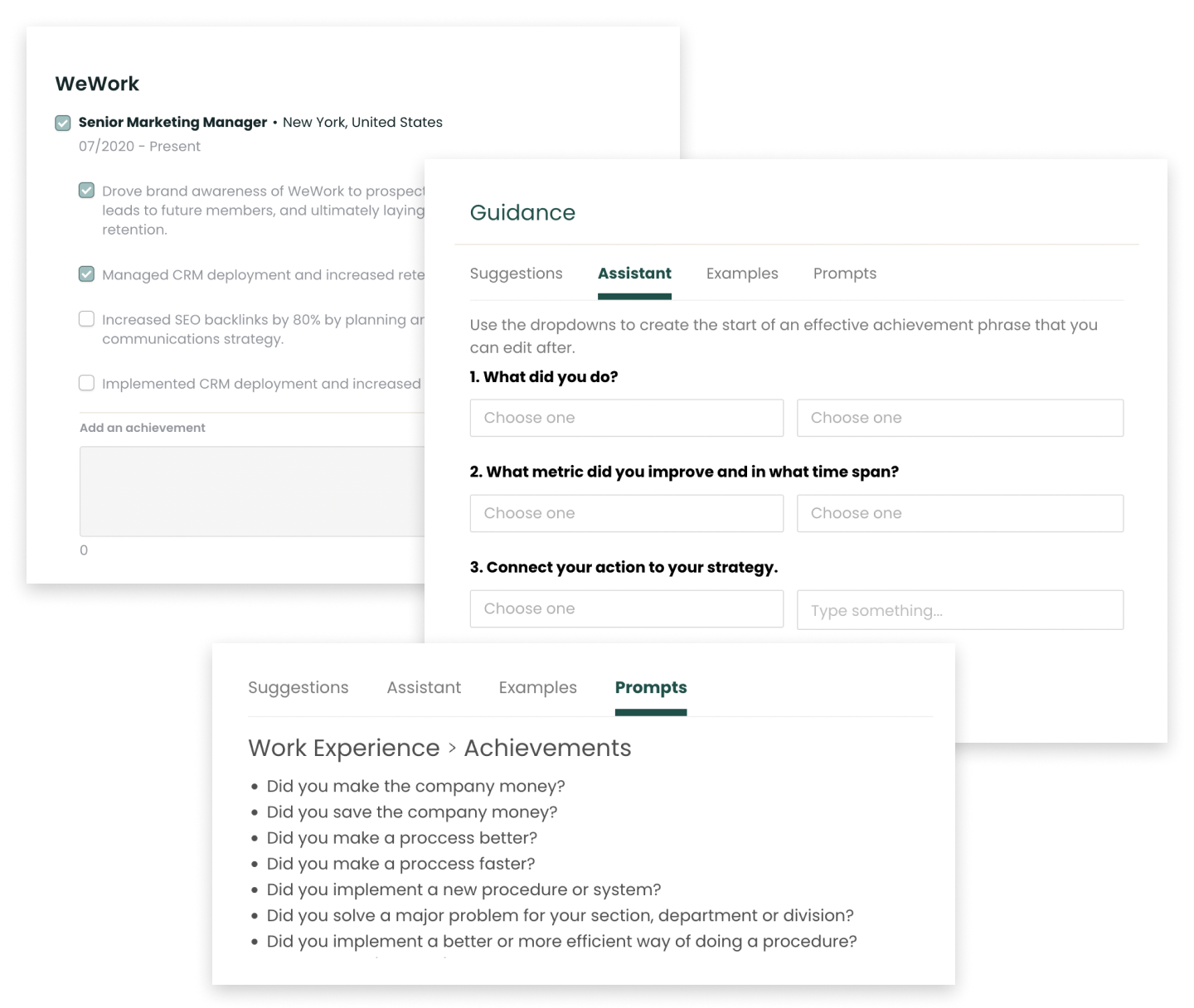

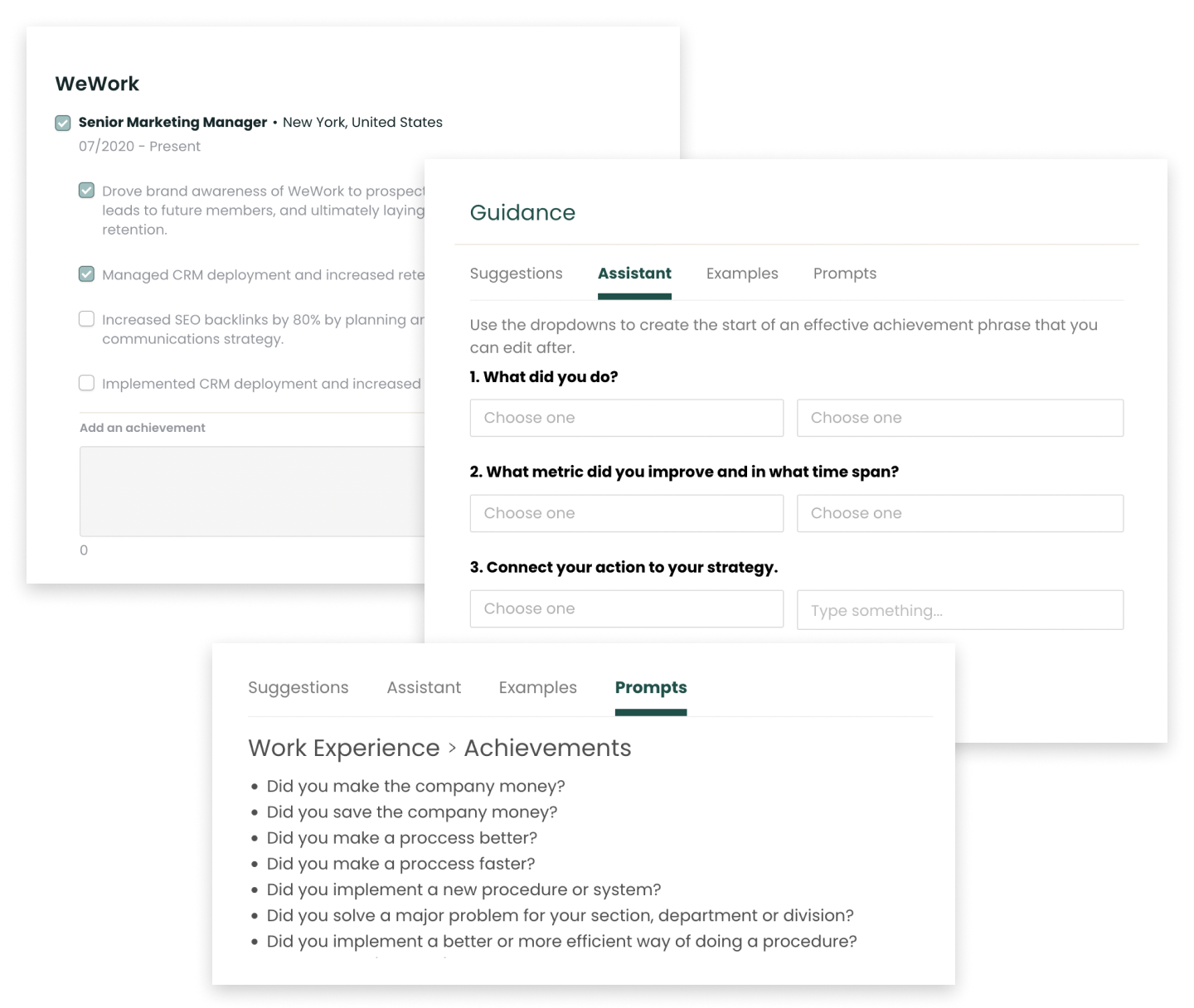

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Tax Managers

Setting professional goals as a Tax Manager is essential for navigating the complexities of tax law and regulations while advancing your career. These goals not only help in achieving compliance and optimization for your organization but also in carving out a path for professional growth and expertise. Below are thoughtfully crafted professional goal examples for Tax Managers, each designed to foster career progression and enhance the value they bring to their roles.

Enhance Tax Compliance Knowledge

Stay ahead of the curve by continuously updating your knowledge of tax legislation and international tax laws. This goal involves dedicating time to study new tax codes, attending seminars, and obtaining certifications that solidify your expertise. A Tax Manager well-versed in compliance is invaluable in mitigating risks and ensuring organizational adherence to tax obligations.

Develop Expertise in Tax Planning Strategies

Strive to become an expert in tax planning and strategy. This means going beyond compliance and understanding how to leverage tax laws to benefit the organization financially. By mastering tax planning, you can provide strategic advice that aligns with business goals and maximizes tax efficiency.

Lead a Successful Tax Audit Defense

Set a goal to lead your team through a successful tax audit with minimal adjustments. This will require a thorough understanding of audit processes, meticulous documentation, and strategic negotiation skills. Successfully defending an audit can demonstrate your competence and protect your company's interests.

Implement Tax Technology Solutions

Embrace the digital transformation in tax management by implementing new tax technology solutions. Aim to automate processes, improve data accuracy, and increase efficiency within your tax department. This goal not only streamlines workflows but also positions you as an innovative leader in the field.

Cultivate a Culture of Continuous Learning

Commit to fostering a culture of continuous learning within your tax team. This involves organizing training sessions, encouraging professional development, and staying abreast of best practices. By investing in your team's growth, you enhance collective expertise and adaptability in the face of tax law changes.

Strengthen Stakeholder Communication

Develop your ability to communicate complex tax matters effectively to stakeholders. This goal is about refining your skills in translating technical tax language into clear, actionable insights for decision-makers. Effective communication can lead to better-informed strategies and organizational trust in the tax function.

Obtain a Specialized Tax Certification

Pursue a specialized tax certification, such as Certified Public Accountant (CPA) or Chartered Tax Advisor (CTA), to demonstrate your commitment to the profession and deepen your expertise. This goal not only enhances your credentials but also opens up opportunities for career advancement.

Optimize Tax Processes and Reporting

Set a goal to optimize tax processes and improve the accuracy and timeliness of tax reporting. This may involve re-evaluating existing procedures, leveraging technology, and streamlining operations to reduce errors and enhance efficiency.

Expand International Tax Expertise

For those working in multinational corporations, aim to expand your knowledge of international tax regulations and cross-border transactions. This goal involves understanding the complexities of transfer pricing, tax treaties, and global tax planning to effectively manage the tax challenges of international operations.

Mentor Emerging Tax Professionals

Commit to mentoring junior tax professionals by sharing your knowledge and experiences. This goal not only helps in building a strong team but also establishes you as a leader and resource within the tax community.

Lead Tax Savings Initiatives

Identify and lead initiatives that result in significant tax savings for your organization. This requires a proactive approach to tax strategy, seeking opportunities for credits, deductions, and incentives that align with business activities and investments.

Advocate for Ethical Tax Practices

Set an example by advocating for ethical tax practices within your organization. This goal is about ensuring that tax strategies are not only legal but also socially responsible, reflecting positively on the company's reputation and contributing to a culture of integrity.

Find Tax Manager Openings

Explore the newest Tax Manager roles across industries, career levels, salary ranges, and more.

Career Goals for Tax Managers at Difference Levels

Setting career goals as a Tax Manager is a strategic process that evolves with each stage of your professional journey. As you climb the ladder from entry-level to senior positions, your objectives should not only reflect your growing expertise but also your ability to navigate the complexities of tax regulations and contribute to the broader financial strategies of your organization. Here, we delve into the career goals that Tax Managers should aim for at different levels, providing a roadmap for continuous development and success in the field.

Setting Career Goals as an Entry-Level Tax Manager

At the entry-level, your primary objective is to build a robust foundation in tax principles and practices. Goals should include developing a thorough understanding of tax laws, mastering tax preparation and compliance for various entities, and honing analytical skills to identify tax savings opportunities. Consider setting targets such as obtaining certifications like the CPA or EA, participating in complex tax projects under supervision, and building a network with experienced tax professionals. These goals are designed to establish your credibility and prepare you for the next steps in your tax career.

Setting Career Goals as a Mid-Level Tax Manager

As a mid-level Tax Manager, you're expected to take on greater responsibilities. Your goals should now focus on enhancing your leadership capabilities and strategic thinking. Aim to lead tax planning initiatives, manage risk by staying ahead of regulatory changes, and improve the tax function's efficiency through technology. Consider objectives such as developing specialized expertise in a niche area of tax, representing your company in tax audits, or contributing to tax strategy and policy development. At this stage, your goals should balance technical proficiency with the ability to influence tax decisions and mentor junior staff.

Setting Career Goals as a Senior-Level Tax Manager

Reaching the senior level means you are now a strategic leader in the tax domain. Your goals should encompass not only tax management but also its integration with the company's overall financial strategy. Aim for objectives like shaping the organization's tax policy, optimizing the global tax structure, or leading cross-border tax initiatives. Consider setting goals such as becoming a thought leader in the tax field, driving tax-saving strategies that significantly impact the bottom line, or developing a succession plan for the tax department. As a senior Tax Manager, your goals should demonstrate your comprehensive expertise and your ability to drive strategic tax decisions at the highest level.

Leverage Feedback to Refine Your Professional Goals

Feedback is an indispensable asset for Tax Managers aiming to excel in their careers. It provides invaluable insights from various sources, enabling professionals to hone their skills, adapt to industry changes, and achieve their career objectives with precision.

Utilizing Constructive Criticism to Sharpen Expertise

Constructive criticism is a catalyst for professional growth. Tax Managers should use it to refine their technical knowledge, enhance advisory skills, and ensure their career goals are in sync with the evolving landscape of tax regulations and client expectations.

Incorporating Client Feedback into Career Development

Client feedback is a treasure trove of information that can guide a Tax Manager's career path. By actively listening to clients, Tax Managers can align their professional objectives with the delivery of exceptional service and the creation of tax strategies that resonate with client needs.

Leveraging Performance Reviews for Goal Precision

Performance reviews offer a structured evaluation of a Tax Manager's strengths and areas for improvement. By setting clear, actionable goals based on this feedback, Tax Managers can focus on targeted professional development and strategic career progression.

Goal FAQs for Tax Managers

How frequently should Tax Managers revisit and adjust their professional goals?

Tax Managers should reassess their professional goals at least biannually, aligning with the cyclical nature of tax seasons. This schedule ensures adaptation to regulatory changes, industry trends, and organizational shifts. Regular goal evaluation fosters strategic career development, allowing Tax Managers to stay ahead in a dynamic field and seize emerging leadership opportunities.

Can professional goals for Tax Managers include soft skill development?

Certainly. For Tax Managers, mastering soft skills such as effective communication, negotiation, and team leadership is essential. These skills facilitate clear guidance to staff, improve client relationships, and enhance the ability to navigate complex regulatory environments. Therefore, incorporating soft skill development into professional goals is not only appropriate but also critical for the advancement and success of a Tax Manager.

How do Tax Managers balance long-term career goals with immediate project deadlines?

Tax Managers must adeptly navigate the intersection of immediate compliance and strategic foresight. By prioritizing tasks that align with evolving tax laws and regulations, they ensure that each project not only meets deadlines but also enhances their expertise. This deliberate approach to project management allows Tax Managers to simultaneously address current responsibilities while building a foundation for advanced career opportunities in the ever-changing landscape of tax administration.

How can Tax Managers ensure their goals align with their company's vision and objectives?

Tax Managers should actively engage with senior management to grasp the broader financial objectives of their organization. By integrating these insights into their tax strategies and compliance efforts, they ensure that their professional development and initiatives support the company's fiscal health and strategic goals, fostering a collaborative environment that advances both corporate and personal achievements in the financial landscape.

Up Next

Learn what it takes to become a JOB in 2024