Why Every Loan Officer Should Have Goals

In the dynamic realm of finance, where the currents of market trends and regulatory landscapes shift with unrelenting pace, the role of a Loan Officer is both critical and complex. Setting precise, measurable goals is not merely advantageous; it is imperative. These goals serve as the navigational stars for a Loan Officer's career journey, illuminating the path through the intricate maze of daily tasks and long-term ambitions. They carve out a clear vision of success, ensuring that each calculated risk and client interaction is a deliberate stride towards professional growth.

For Loan Officers, well-defined goals are the scaffolding upon which career progression is built. They foster innovation by challenging professionals to continuously refine their approach to lending, to devise creative solutions that meet the evolving needs of borrowers and the market. Strategic planning, too, is rooted in goal-setting, as it demands a forward-looking mindset and the ability to anticipate and prepare for future financial trends and policy changes.

Leadership within the financial sector is markedly enhanced by goal alignment. When Loan Officers align their personal ambitions with the objectives of their teams and the broader vision of their organizations, they create a synergy that propels not only their own careers but also the success of their colleagues and the institution as a whole. This harmony between individual and collective goals ensures that every member of the team is rowing in unison, driving the organization forward with a shared sense of purpose and direction.

This introduction is designed to be both motivational and pragmatic, offering Loan Officer professionals tangible insights into the transformative power of goal-setting. It aims to inspire readers to recognize the indispensable value of well-articulated goals, and to wholeheartedly embrace them as essential tools in sculpting their career trajectory within the finance industry.

Different Types of Career Goals for Loan Officers

In the dynamic world of finance, Loan Officers play a pivotal role in connecting clients with the right loan products to meet their needs. Establishing a variety of career goals is essential for Loan Officers who aim to excel in their field. By identifying and pursuing a mix of objectives, professionals can ensure they are not only achieving short-term wins but also paving the way for long-term career success. Understanding the spectrum of career goals can help Loan Officers create a comprehensive plan for their professional journey, balancing the immediate demands of their role with their broader aspirations in the financial industry.

Industry Knowledge and Compliance Goals

Staying abreast of the ever-changing regulations and industry standards is vital for Loan Officers. Goals in this category may include obtaining certifications such as the Mortgage Loan Originator (MLO) license, or staying updated with the latest federal and state lending laws. Mastery of compliance ensures that you can confidently navigate the legal aspects of lending, protecting both your clients and your institution from potential risks.

Customer Service and Relationship Building Goals

Loan Officers must excel in customer service and relationship management. Setting goals to improve client satisfaction rates or to expand your referral network through exceptional service can lead to a more robust client base and a reputation for reliability. Whether it's through personalized communication strategies or learning new CRM software, enhancing these skills can significantly impact your career trajectory.

Sales and Marketing Goals

The ability to effectively market loan products and close deals is at the heart of a Loan Officer's role. Goals might include mastering new sales techniques, learning about digital marketing strategies to attract clients, or setting personal targets for loan volume or number of closed loans. By focusing on sales and marketing objectives, you can increase your value to your employer and potentially boost your earnings through commissions and bonuses.

Networking and Professional Development Goals

Building a strong professional network and continuing your education are crucial for long-term success. Goals could involve attending industry conferences, joining professional associations, or pursuing further education such as an MBA with a focus on finance. These activities not only provide opportunities for learning and growth but also open doors to potential career advancements and collaborations.

Technological Proficiency Goals

In an era where technology is reshaping the financial landscape, Loan Officers must aim to stay ahead of the curve. Setting goals to learn about emerging financial technologies, loan origination systems, or data analysis tools can enhance efficiency and decision-making. Technological proficiency allows you to streamline processes, offer innovative solutions to clients, and maintain a competitive edge in the market.

By setting and pursuing a diverse array of career goals, Loan Officers can ensure they are well-equipped to meet the demands of their role and to seize opportunities for advancement. Balancing the pursuit of knowledge, customer service excellence, sales acumen, professional networking, and technological savvy will position Loan Officers for a rewarding and successful career in the financial sector.

What Makes a Good Career Goal for a Loan Officer?

In the competitive and ever-evolving landscape of finance, Loan Officers who set clear and actionable career goals are better equipped to navigate the complexities of the industry. These goals are not just milestones to be achieved; they are the driving force behind a Loan Officer's ability to excel in client service, financial acumen, and innovative lending solutions. They shape a professional who is not only adept at meeting targets but also at forging lasting relationships and staying ahead of market trends.

Career Goal Criteria for Loan Officers

Expertise and Knowledge Expansion

A Loan Officer's career goal should include the pursuit of deepened expertise and knowledge in both financial products and the regulatory landscape. Mastery of these areas ensures that you can provide exceptional advice and service to clients, navigate the complexities of lending laws, and remain competitive in the field.

Acquire Certifications in Lending

Stay Abreast of Regulation Changes

Specialize in Niche Loan Products

Relationship-Building Proficiency

Loan Officers thrive on strong relationships with clients, colleagues, and industry contacts. Goals centered around enhancing interpersonal skills and networking abilities are crucial. They enable Loan Officers to expand their client base, foster trust, and secure repeat business, which is vital for long-term success.

Expand Referral Networks

Enhance Client Communication

Build Industry Partnerships

Technological Adaptability

With the financial industry increasingly leaning on technology, Loan Officers must set goals to stay abreast of and adapt to new tech tools. This includes learning new loan origination software, understanding data analysis, and embracing digital communication platforms, ensuring efficiency and a competitive edge.

Master Loan Management Software

Analyze Trends with Data Tools

Upgrade Digital Client Interaction

Sales and Marketing Acumen

Loan Officers must also aim to refine their sales and marketing techniques. Setting goals to improve these skills can lead to better client conversion rates and a stronger personal brand. This is particularly important for Loan Officers who rely on their reputation and visibility in the market to attract and retain clients.

Develop a Personal Brand

Enhance Client Relationship Skills

Master Product Knowledge

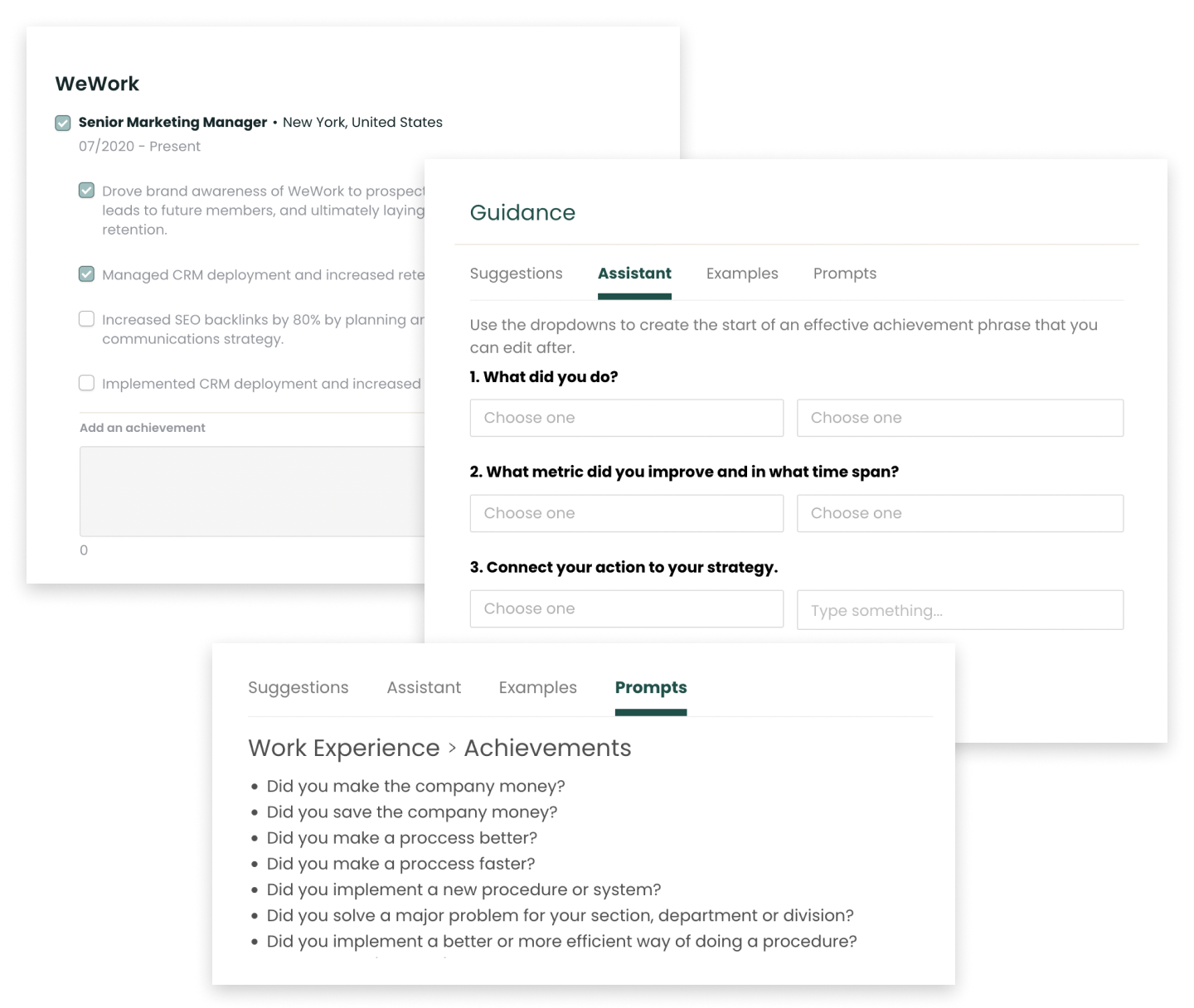

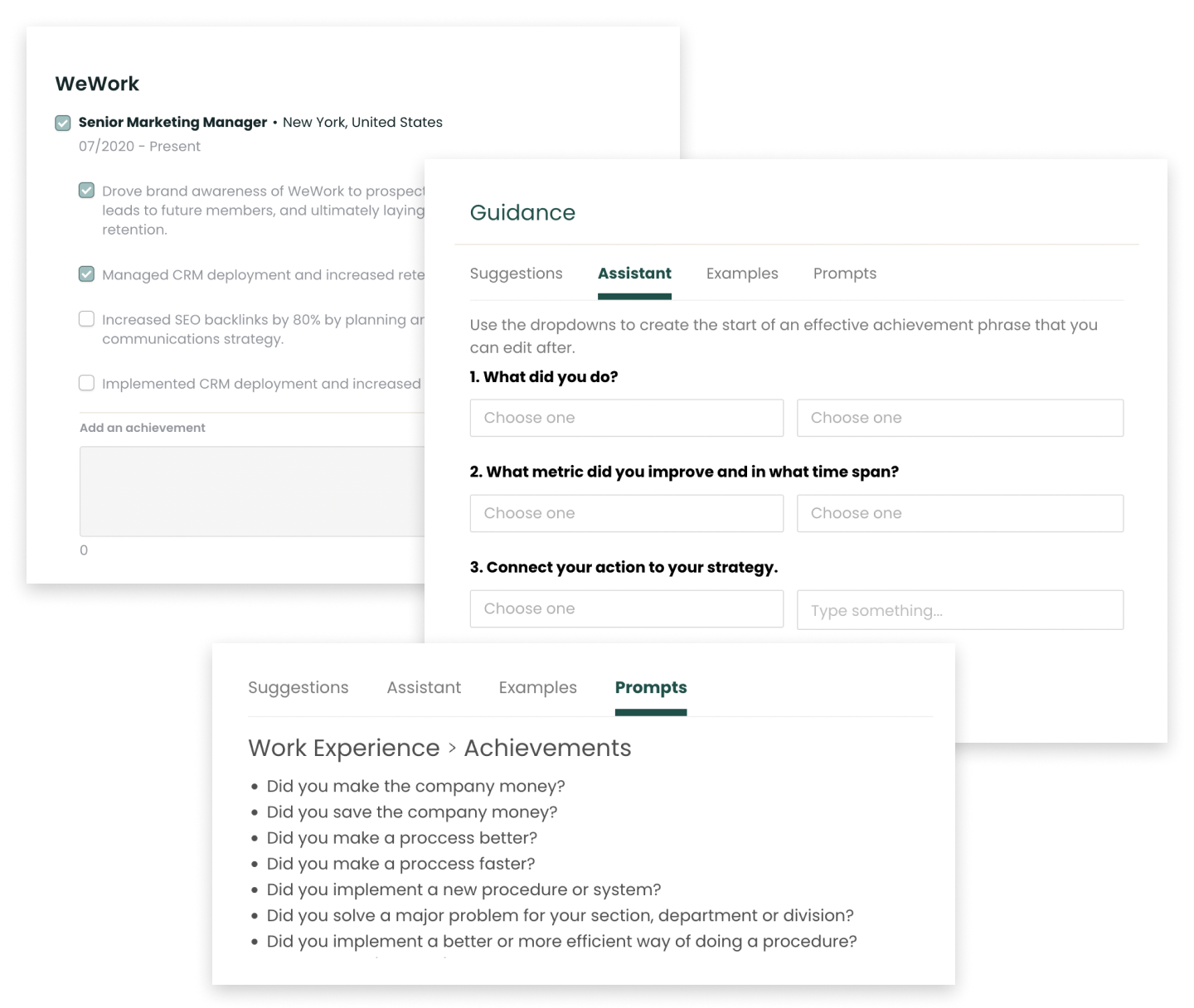

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Loan Officers

Setting professional goals is essential for Loan Officers who aim to excel in their careers. These goals not only provide a clear direction for personal and professional growth but also enhance the ability to manage client relationships, navigate complex financial regulations, and contribute to the success of their financial institutions. Here are several professional goal examples designed to inspire Loan Officers in their pursuit of excellence and career progression.

Enhance Financial Product Knowledge

As a Loan Officer, staying informed about the latest financial products and services is paramount. Set a goal to regularly attend industry workshops, complete courses, or obtain certifications that deepen your understanding of mortgage products, personal loans, and other financial instruments. This knowledge is crucial for providing accurate, tailored advice to clients.

Develop Stronger Client Relationship Skills

Commit to building and maintaining robust client relationships. This goal involves improving your communication skills, being responsive to client needs, and providing exceptional service that goes beyond their expectations. Strong relationships lead to repeat business and referrals, which are the lifeblood of a successful Loan Officer's career.

Achieve a Higher Loan Approval Rate

Work towards increasing your loan approval rate by refining your ability to assess and advocate for qualified loan applicants. This goal requires a keen eye for detail in reviewing financial documents, a solid understanding of underwriting criteria, and the ability to present a compelling case to the loan committee.

Expand Your Professional Network

Set a goal to actively grow your professional network through industry associations, community events, and social media platforms like LinkedIn. Networking can lead to new business opportunities, partnerships, and a better understanding of market trends that affect your clients.

Improve Risk Assessment Abilities

Aim to enhance your risk assessment skills to better evaluate the creditworthiness of loan applicants. This goal involves staying current with economic trends, understanding the impact of regulatory changes, and using advanced risk assessment tools to minimize defaults and protect your institution's interests.

Master Regulatory Compliance

Loan Officers must navigate a complex regulatory landscape. Set a goal to become an expert in compliance, ensuring that all loans you process meet state and federal regulations. This expertise not only mitigates legal risks but also builds trust with clients and your institution.

Increase Loan Portfolio Growth

Strive to grow your loan portfolio by setting specific targets for loan volume and diversity. This goal challenges you to identify new market segments, develop strategies for reaching potential borrowers, and work closely with marketing teams to create effective campaigns.

Enhance Sales and Marketing Techniques

Loan Officers often need to employ sales tactics to attract clients. Aim to refine your sales and marketing skills by learning new strategies, adopting cutting-edge technologies, and personalizing your approach to meet the unique needs of each client.

Cultivate Financial Counseling Skills

Set a goal to become a trusted financial advisor to your clients by enhancing your financial counseling skills. This involves understanding the broader financial picture of your clients, providing guidance on credit repair, and helping them make informed decisions about their financial futures.

Lead a Team or Department

If leadership is in your career path, aim to take on a managerial role where you can lead a team or department. This goal will have you developing management skills, mentoring junior Loan Officers, and driving your team towards achieving business objectives.

Implement Technology Solutions

Embrace the digital transformation in the financial industry by implementing technology solutions that streamline loan processing. This goal is about identifying and integrating software that improves efficiency, enhances customer experience, and ensures data security.

Pursue Continuing Education

Commit to lifelong learning by pursuing continuing education opportunities. Whether it's earning a higher degree, obtaining industry-specific certifications, or attending seminars on emerging financial trends, this goal ensures you remain competitive and knowledgeable in a rapidly evolving field.

Find Loan Officer Openings

Explore the newest Loan Officer roles across industries, career levels, salary ranges, and more.

Career Goals for Loan Officers at Difference Levels

Setting career goals as a Loan Officer is essential for navigating the complexities of the financial industry and ensuring a trajectory of professional growth and success. As Loan Officers progress from entry-level to senior positions, their objectives must evolve to reflect their expanding expertise, responsibilities, and the strategic value they bring to their organization. By aligning career goals with the challenges and opportunities at each stage, Loan Officers can create a clear path for advancement and achieve their professional aspirations.

Setting Career Goals as an Entry-Level Loan Officer

At the entry-level, Loan Officers should focus on acquiring a deep understanding of lending products, regulations, and client relationship management. Goals might include completing certification programs such as the American Bankers Association (ABA) Certificate in Lending Compliance, developing proficiency in loan origination software, or successfully closing a set number of loans within the first year. These objectives are foundational, equipping new Loan Officers with the knowledge and skills necessary to build credibility and trust with clients and colleagues.

Setting Career Goals as a Mid-Level Loan Officer

Mid-level Loan Officers have a solid grasp of the basics and are now positioned to expand their influence and expertise. Goals at this stage should encourage specialization in a particular type of lending, such as commercial or mortgage loans, and focus on developing leadership skills. Consider objectives like increasing loan portfolio size by a certain percentage, improving loan approval rates through better risk assessment, or leading a team project to streamline the loan application process. Mid-level goals should balance the pursuit of quantifiable business outcomes with personal development in areas like negotiation and strategic thinking.

Setting Career Goals as a Senior-Level Loan Officer

Senior Loan Officers are expected to be strategic thinkers and leaders in their field. Goals should be set with a view to shaping the direction of the lending department or institution. This could involve setting objectives like developing and implementing new lending strategies to capture emerging market segments, mentoring and developing junior Loan Officers, or playing a key role in navigating the institution through regulatory changes. At this level, goals should not only demonstrate a Loan Officer's deep expertise and leadership but also their ability to drive growth and adapt to the ever-changing financial landscape.

Leverage Feedback to Refine Your Professional Goals

Feedback is an invaluable asset for Loan Officers, serving as a compass for navigating the complexities of the financial industry. It provides insights into performance, customer satisfaction, and industry standards, all of which are essential for shaping a successful career in loan origination and management.

Utilizing Constructive Criticism to Sharpen Lending Acumen

Constructive criticism is a powerful tool for Loan Officers. It can highlight areas for improvement in loan processing, risk assessment, and customer service. Embrace this feedback to refine your approach, enhance your financial knowledge, and ensure your professional goals are in sync with the industry's best practices.

Incorporating Customer Insights into Career Development

Customer feedback is a direct line to understanding the impact of your service. Use these insights to tailor your communication skills, develop empathy, and improve your ability to design loan products that cater to your clients' needs. Aligning your career goals with customer satisfaction can lead to increased referrals and a robust professional reputation.

Leveraging Performance Reviews for Strategic Goal Setting

Performance reviews offer a structured evaluation of your achievements and areas needing attention. Analyze this feedback to set clear, actionable goals that focus on enhancing your strengths and addressing any weaknesses. This strategic approach to goal setting can accelerate your career progression and ensure you remain a competitive force in the loan industry.

Goal FAQs for Loan Officers

How frequently should Loan Officers revisit and adjust their professional goals?

Loan Officers should evaluate their professional goals at least semi-annually, aligning with the fluctuating financial landscape and regulatory changes. This biannual check-in fosters adaptability to new lending practices, client needs, and technological advancements. Staying current with these shifts ensures Loan Officers can proactively refine their strategies, maintain relevance in the market, and pursue continuous career development.

Can professional goals for Loan Officers include soft skill development?

Certainly. For Loan Officers, honing soft skills such as interpersonal communication, active listening, and customer service is vital. These competencies facilitate trust-building with clients, effective negotiation of loan terms, and can improve customer satisfaction and retention. Setting goals to refine these soft skills is not only appropriate but essential for fostering long-term client relationships and succeeding in the financial services industry.

How do Loan Officers balance long-term career goals with immediate project deadlines?

Loan Officers can harmonize long-term ambitions with pressing deadlines by integrating professional development into their daily workflow. They should view each client interaction and loan process as an opportunity to refine skills like risk assessment and customer service, which are crucial for career advancement. Effective prioritization and efficient time management allow them to meet immediate targets while steadily progressing towards their overarching career objectives.

How can Loan Officers ensure their goals align with their company's vision and objectives?

Loan Officers can align their goals with their company's vision by staying informed about the organization's targets and market position. Regularly engaging with management to understand evolving objectives and tailoring their approach to customer service and loan portfolio management to reflect these insights ensures their contributions advance the company's mission, fostering a culture of unity and progress within the financial services sector.

Up Next

Learn what it takes to become a JOB in 2024