Why Every Revenue Accountant Should Have Goals

In the meticulous and dynamic realm of revenue accounting, the establishment of precise, quantifiable goals is not merely advantageous—it is imperative. These goals serve as the navigational beacon of your career, steering every meticulous analysis, fiscal interpretation, and tactical maneuver. They crystallize the concept of success, ensuring that each calculated move aligns with your professional trajectory. For Revenue Accountants, well-defined objectives are the bedrock of career progression, fostering innovation, strategic foresight, and the capacity to guide teams in harmony with the financial pulse of the organization.

Goals are the lenses through which daily tasks gain purpose and long-term ambitions become attainable. They transform routine number-crunching into strategic contributions, shaping the future of the business one ledger at a time. Through goal-setting, Revenue Accountants not only enhance their own expertise but also drive the financial innovation that keeps businesses ahead of the curve. Moreover, when individual goals resonate with team milestones and the broader vision of the company, a powerful synergy emerges, leading to a cohesive and forward-thinking accounting department.

This introduction is designed to motivate and provide practical insights into the indispensable nature of goal-setting for Revenue Accountant professionals. It aims to inspire readers to acknowledge and harness the power of well-articulated goals, propelling their careers to new heights of analytical acumen and fiscal leadership.

Different Types of Career Goals for Revenue Accountants

In the dynamic world of finance, Revenue Accountants play a critical role in ensuring the accuracy and integrity of a company's financial statements. Setting clear career goals is essential for these professionals to navigate the complexities of revenue recognition and to advance in their careers. By understanding the various types of career goals, Revenue Accountants can craft a balanced strategy that encompasses both the immediate needs of their role and their long-term professional aspirations. This approach not only enhances their current performance but also paves the way for future opportunities and success.

Technical Proficiency Goals

Technical proficiency goals are centered around gaining expertise in the specific accounting standards and software that are pivotal in revenue accounting. This could involve becoming proficient in ASC 606, the revenue recognition standard, or mastering advanced features of ERP systems. By focusing on these goals, Revenue Accountants ensure they are equipped to handle complex transactions and maintain compliance with evolving regulations.

Regulatory and Compliance Goals

Regulatory and compliance goals are critical for Revenue Accountants who must stay abreast of the latest tax laws and accounting regulations. These goals might include obtaining certifications such as the CPA (Certified Public Accountant) or CMA (Certified Management Accountant), or attending workshops and seminars on the latest GAAP updates. Achieving these goals demonstrates a commitment to maintaining the highest standards of financial reporting and ethical practice.

Strategic Business Partnering Goals

Strategic business partnering goals focus on the Revenue Accountant's role in influencing business decisions and strategy. This involves developing a deep understanding of the business operations and cultivating relationships with key stakeholders. Goals may include cross-departmental projects to streamline revenue processes or initiatives to provide strategic financial insights that drive business growth. By achieving these goals, Revenue Accountants become invaluable advisors within their organizations.

Leadership and Management Goals

Leadership and management goals are essential for Revenue Accountants aspiring to move into supervisory or managerial positions. These goals could involve developing strong team-building skills, improving communication abilities, or leading a successful finance transformation project. By setting and accomplishing these goals, Revenue Accountants position themselves as leaders who can effectively manage teams and drive departmental success.

Personal Development Goals

Personal development goals are about expanding one's own capabilities and effectiveness as a professional. For Revenue Accountants, this could mean enhancing public speaking skills for presenting financial data, learning a new language to work with international clients, or pursuing a work-life balance that fosters sustained productivity. Personal development is a continuous process that contributes to overall career satisfaction and achievement.

By setting goals across these diverse categories, Revenue Accountants can create a comprehensive roadmap for their career development. This holistic approach not only fosters professional growth but also ensures that they remain adaptable and resilient in the ever-changing landscape of accounting and finance.

What Makes a Good Career Goal for a Revenue Accountant?

In the meticulous and ever-evolving field of accounting, setting precise career goals is not just about climbing the corporate ladder; it's about becoming a beacon of financial insight and integrity. For Revenue Accountants, whose expertise directly impacts a company's financial health, well-defined goals are the cornerstone of professional excellence and innovation. They fuel not only career advancement but also the development of strategic acumen and leadership prowess.

Career Goal Criteria for Revenue Accountants

Mastery of Revenue Recognition Standards

A paramount career goal for Revenue Accountants is to achieve and maintain an in-depth understanding of revenue recognition standards, such as ASC 606 and IFRS 15. This knowledge is crucial as it ensures compliance and accuracy in reporting. It also positions the accountant as an invaluable resource for navigating complex revenue scenarios, which is essential for the financial stability and reputation of the organization.

Stay updated on standard changes

Implement robust compliance systems

Develop expertise in sector-specific revenue

Proficiency in Data Analysis and Forecasting

In today's data-driven business environment, a Revenue Accountant must aim to become proficient in data analysis and revenue forecasting. This goal is vital as it transcends traditional accounting roles, allowing the professional to provide strategic insights that inform business decisions and drive growth. It also reflects a commitment to embracing technological advancements and analytical tools that are transforming financial reporting.

Master Revenue Recognition Standards

Utilize Advanced Analytic Software

Develop Predictive Financial Models

Cross-Functional Collaboration and Communication

Setting a goal to enhance cross-functional collaboration and communication skills is critical for Revenue Accountants. As financial gatekeepers, they must effectively liaise with sales, legal, and operations teams to ensure revenue processes are aligned with business activities. Excelling in this area promotes a holistic understanding of the business and fosters a culture of transparency and shared objectives.

Master Interdepartmental Protocols

Develop Clear Communication Channels

Build Consensus on Revenue Recognition

Leadership in Ethical Financial Practices

A good career goal for Revenue Accountants is to become a leader in ethical financial practices. This involves not only adhering to the highest standards of integrity but also advocating for ethical decision-making across the company. By championing ethical practices, Revenue Accountants safeguard the organization's reputation and contribute to a sustainable business model.

Champion Transparency in Reporting

Advocate for Fair Revenue Recognition

Lead with Integrity in Audits

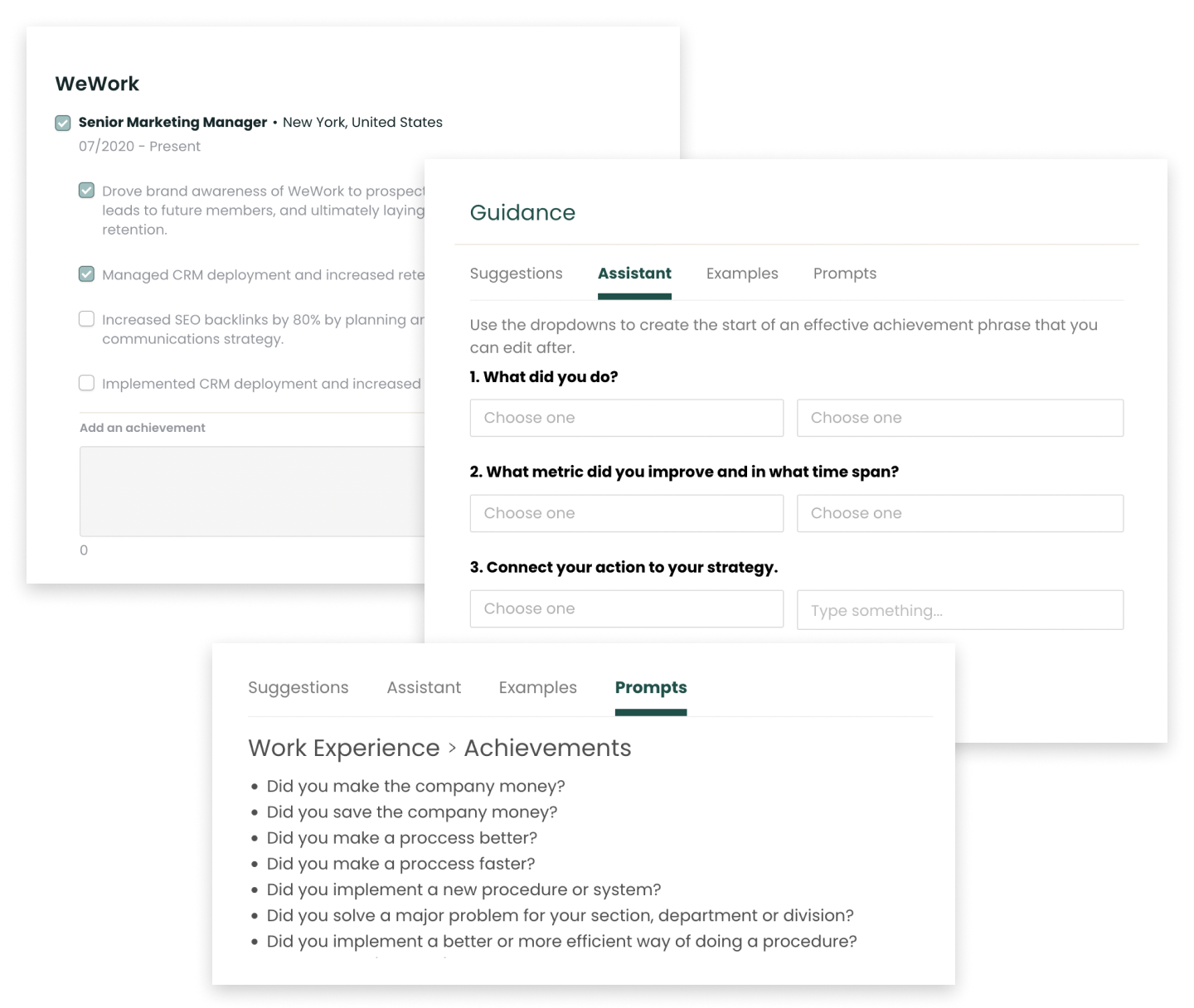

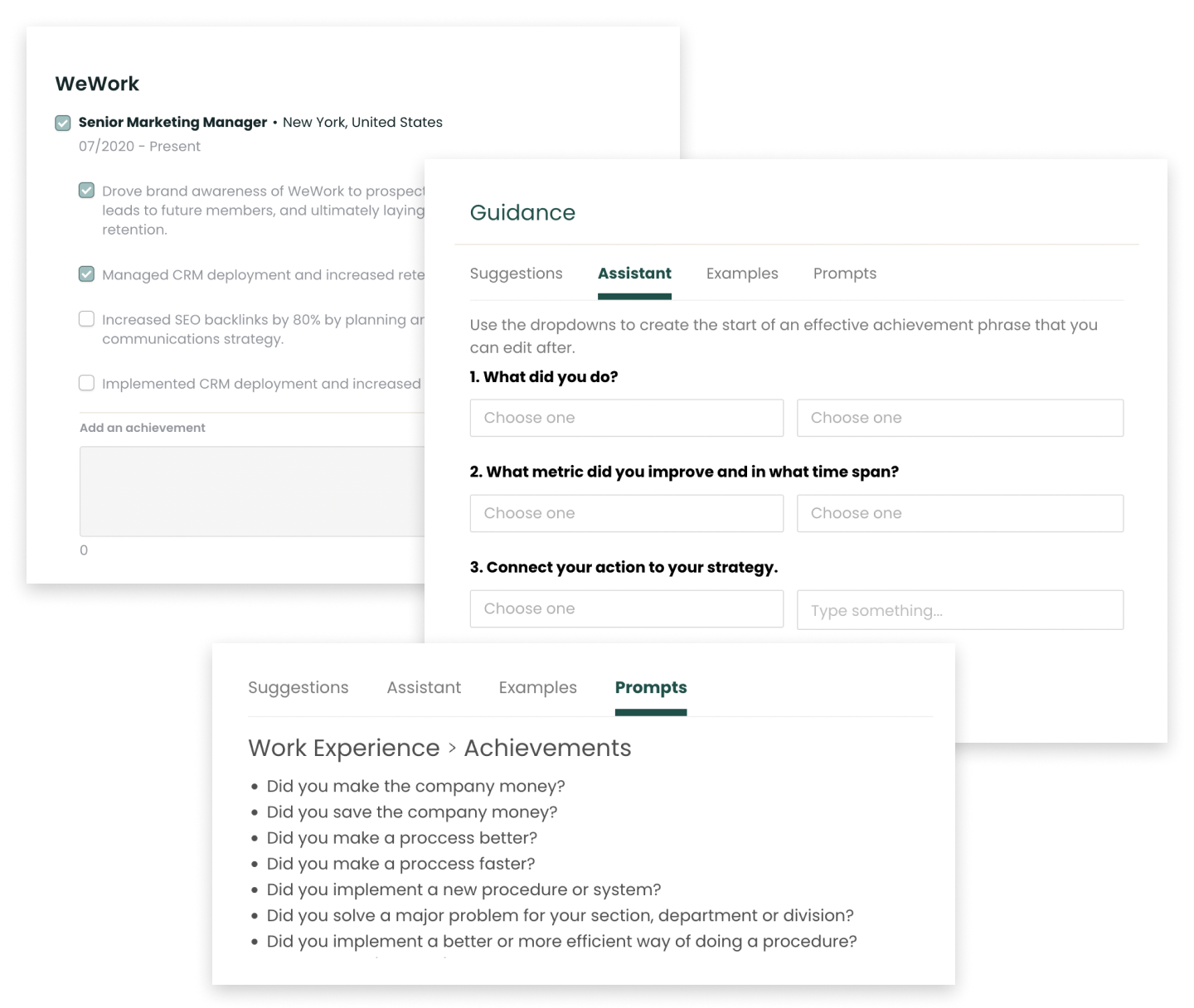

Log Your Wins Every Week with Teal

Document your career wins and achievements every week while they are fresh, then add them when you need.

Track Your Achievements for Free

12 Professional Goal Examples for Revenue Accountants

Setting professional goals is essential for Revenue Accountants who aim to excel in their field. These goals not only provide a clear path for career advancement but also enhance the ability to manage financial records and ensure compliance with revenue recognition standards. By setting and achieving these goals, Revenue Accountants can elevate their expertise, contribute to the financial success of their organizations, and shape their career trajectory with precision and foresight.

Master Revenue Recognition Standards

As revenue recognition rules continue to evolve, staying current with the latest accounting standards, such as ASC 606 and IFRS 15, is imperative. Set a goal to deepen your understanding of these regulations and how they impact your company's financial reporting. This expertise will ensure accuracy in financial statements and enhance your value as a trusted revenue expert.

Enhance Analytical Skills

Develop your ability to analyze revenue streams and financial data to identify trends, forecast future revenue, and support strategic business decisions. Aim to master analytical tools and software that can help you provide more insightful reports, ultimately contributing to the company's financial health and strategic planning.

Automate Revenue Processes

Set a goal to lead or contribute to the automation of revenue accounting processes within your organization. By implementing software solutions that streamline billing, collections, and revenue recognition, you can increase efficiency, reduce errors, and free up time to focus on more strategic tasks.

Improve Interdepartmental Collaboration

Work towards building stronger relationships with sales, operations, and legal teams to ensure that revenue-related decisions are well-informed and aligned with the company's objectives. Effective collaboration will lead to better contract structuring, accurate revenue forecasting, and overall improved financial management.

Attain Advanced Certifications

Pursue advanced certifications such as the Certified Public Accountant (CPA) or Chartered Accountant (CA) designation. These credentials not only demonstrate your commitment to the profession but also expand your knowledge base, making you a more competitive candidate for senior roles.

Develop Leadership Skills

Aspire to take on leadership roles within your accounting team. This could involve supervising junior staff, leading training sessions, or managing a segment of the revenue cycle. Leadership development will prepare you for higher-level positions and enable you to contribute more significantly to your organization.

Specialize in Industry-Specific Revenue Accounting

Consider specializing in revenue accounting for a specific industry, such as technology, healthcare, or manufacturing. Specialization can make you an invaluable asset to companies within that sector and open up opportunities for niche consulting roles or senior positions in industry-leading firms.

Foster Ethical Financial Practices

Commit to upholding and advocating for ethical financial practices within your organization. This goal involves staying vigilant against fraud, ensuring transparency in revenue reporting, and maintaining the integrity of financial records, which is crucial for investor trust and regulatory compliance.

Expand Your Tax Knowledge

Enhance your understanding of tax implications related to revenue, including sales tax, VAT, and other indirect taxes. By becoming well-versed in tax matters, you can provide more comprehensive advice to your company and avoid potential legal and financial pitfalls.

Contribute to Financial Strategy

Aim to play a more strategic role in your company by using your revenue accounting expertise to influence financial planning and business strategy. This goal will have you working closely with executive leadership to shape the financial direction of the company and drive long-term growth.

Embrace Digital Transformation

Stay ahead of the curve by embracing digital transformation in the accounting field. Learn about emerging technologies such as blockchain, AI, and machine learning, and how they can be applied to revenue accounting to improve accuracy, efficiency, and decision-making.

Mentor and Train Peers

Set a goal to mentor and train peers and junior accountants in revenue accounting best practices. Sharing your knowledge not only reinforces your own expertise but also contributes to the development of a skilled and knowledgeable accounting team.

Find Revenue Accountant Openings

Explore the newest Revenue Accountant roles across industries, career levels, salary ranges, and more.

Career Goals for Revenue Accountants at Difference Levels

Setting career goals as a Revenue Accountant is a strategic endeavor that requires an understanding of the evolving nature of the role across different career stages. As you progress from an entry-level position to a senior-level role, your objectives must adapt to reflect your expanding expertise, the complexity of challenges you face, and the opportunities for growth within the field. Below, we delve into the career goals that are pertinent to Revenue Accountants at various levels, providing a roadmap for professional development that is both ambitious and achievable.

Setting Career Goals as an Entry-Level Revenue Accountant

At the entry-level, your primary aim is to establish a strong knowledge base in revenue accounting principles and practices. Goals should include mastering the use of accounting software, understanding the intricacies of revenue recognition standards such as ASC 606, and accurately reporting financial transactions. Additionally, focus on developing strong analytical skills to interpret financial data and assist in the monthly close process. These foundational goals are essential for building the confidence and competence needed to excel in the field of revenue accounting.

Setting Career Goals as a Mid-Level Revenue Accountant

As a mid-level Revenue Accountant, you're expected to take on more complex tasks and demonstrate leadership potential. Set goals that challenge you to optimize revenue processes, identify and implement improvements in revenue forecasting, and ensure compliance with evolving financial regulations. Consider pursuing a certification such as the CPA or CMA to solidify your expertise. At this stage, your objectives should also include mentoring junior staff and collaborating effectively with cross-functional teams to support the broader financial strategy of your organization.

Setting Career Goals as a Senior-Level Revenue Accountant

At the senior level, your goals should reflect a shift from individual contribution to strategic leadership. Aim to influence the financial direction of your company by developing comprehensive revenue recognition policies and internal controls that align with long-term business objectives. Consider setting goals around leading departmental initiatives, driving automation and process improvements, and acting as a key advisor to executive management on revenue-related matters. As a senior Revenue Accountant, your objectives should not only showcase your deep expertise but also your ability to shape financial strategy and contribute to the company's success on a larger scale.

Leverage Feedback to Refine Your Professional Goals

Feedback is an invaluable asset for Revenue Accountants, serving as a compass for navigating the complexities of financial reporting and compliance. It provides insights that can shape a more effective career path, ensuring that professional objectives are not only met but exceeded.

Utilizing Constructive Criticism to Sharpen Financial Acumen

View constructive criticism as a catalyst for professional refinement. Harness it to enhance your understanding of revenue recognition principles, improve analytical skills, and align your career goals with the high standards of accuracy and strategic financial management required in the field.

Incorporating Customer Feedback into Financial Strategies

Customer feedback is a treasure trove of information that can inform your approach to revenue accounting. Use it to tailor your financial reporting and forecasting methods, ensuring they meet the needs of both internal and external stakeholders, thereby driving your career towards a path of customer-centric financial excellence.

Leveraging Performance Reviews for Career Progression

Performance reviews are a mirror reflecting your professional strengths and areas for growth. Analyze them to set precise, actionable goals that focus on enhancing your expertise in revenue accounting, compliance, and strategic financial planning, ensuring your career development is in lockstep with industry best practices.

Goal FAQs for Revenue Accountants

How frequently should Revenue Accountants revisit and adjust their professional goals?

Revenue Accountants should evaluate their professional goals biannually, aligning with fiscal periods to stay attuned to industry shifts and regulatory changes. This cadence supports proactive career development, ensuring skills and objectives are in sync with evolving accounting standards and organizational strategies, while also allowing for adaptation to technological advancements that impact financial reporting and revenue recognition practices.

Can professional goals for Revenue Accountants include soft skill development?

Certainly. For Revenue Accountants, soft skills such as effective communication, problem-solving, and adaptability are vital. These skills facilitate clear discussions with cross-functional teams, aid in navigating complex revenue recognition scenarios, and enable adaptation to regulatory changes. Therefore, incorporating soft skill development into professional goals is not only appropriate but essential for the growth and success of a Revenue Accountant.

How do Revenue Accountants balance long-term career goals with immediate project deadlines?

Revenue Accountants can harmonize long-term ambitions with pressing deadlines by integrating professional development into their routine tasks. They should approach each accounting cycle and reporting period as an opportunity to refine skills, such as analytical proficiency and regulatory compliance, which are pivotal for career advancement. Effective prioritization and leveraging technology for efficiency ensures they meet immediate objectives while steadily progressing towards their overarching career milestones.

How can Revenue Accountants ensure their goals align with their company's vision and objectives?

Revenue Accountants can align their goals with their company's vision by staying informed about the organization's financial targets and strategic plans. Engaging with financial forecasts, understanding the impact of revenue on company growth, and proactively identifying areas for financial optimization ensure that their expertise directly supports and enhances the company's objectives, fostering a culture of accountability and strategic financial management.

Up Next

What is a Revenue Accountant?

Learn what it takes to become a JOB in 2024